Why is the Fed engaged in community development?

Stable

communities

promote a more robust

economy

Through applied research, public programs, outreach and technical assistance, Federal Reserve community development teams help promote economic growth and financial stability in low- and moderate-income communities across the country.

Welcome to Fed Communities

Your gateway to insights for the community development field from the Federal Reserve.

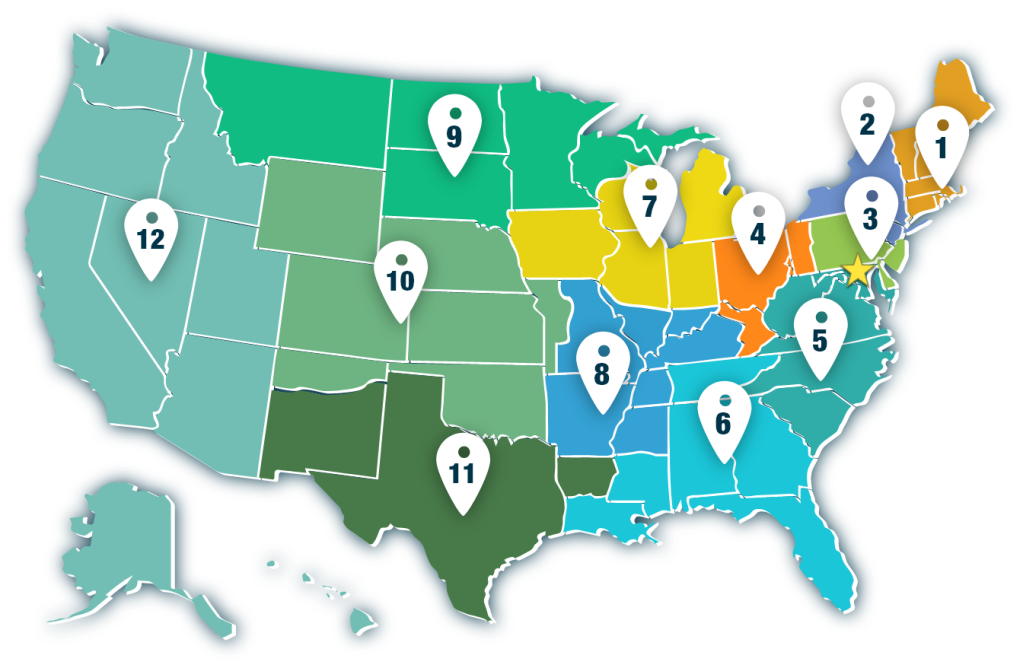

Does your work support people, places, the policy and practice of community development, or small-business development? Fed Communities is a first stop for research, insights, data, and events for community development professionals from the United States central bank, including all 12 Federal Reserve Banks and the Federal Reserve Board of Governors.

Read stories of impact

Here’s how people across the nation are working to address the economic challenges facing their local low- and moderate-income communities, with a focus on workable solutions.

Join us for an event

Tap into discussions around independent and nonpartisan research that aims to help workers, small business owners, and underserved communities across the nation

Explore the data

What will best serve the needs of employers, workers, and communities? From survey findings to dashboards, the Fed’s data can inform collaborative efforts between policymakers, employers, and educators.

Subscribe to our monthly newsletter for our latest articles and event listings.

Follow Us

Find an expert

Connect with Fed community development research and outreach professionals.

Meet our leadership

Get to know the Federal Reserve leaders advising and guiding Fed Communities

Attend an event

Conveniently attend with virtual, in-person, and hybrid options.

Read the latest from our blog

Community perspectives and conditions from the Fed’s Beige Book, April 2025

Here’s what nonprofit and community leaders, and workforce professionals serving lower-income people shared with the Federal Reserve for the April 2025 Beige Book.

Debt-related license suspensions put the brakes on employment

Debt-related driver’s license suspensions can keep people out of the workforce and make it hard for businesses to find and keep the employees they need. Research and practical interventions are helping to change that.

How have CDFIs leveraged various funding mechanisms? Federal Reserve survey aims to find out

Community Development Financial Institutions (CDFIs) are important to closing gaps in credit and capital access. The 2025 CDFI Survey aims to dive into specific topics or challenges in the CDFI landscape.

Thank you to our contributors

We thank the 12 Federal Reserve Banks and Federal Reserve Board of Governors for their contributions to Fed Communities.