Twitter gets lots of grief from investors because it hasn't taken over the world the way Facebook did, at least in terms of amassing users.

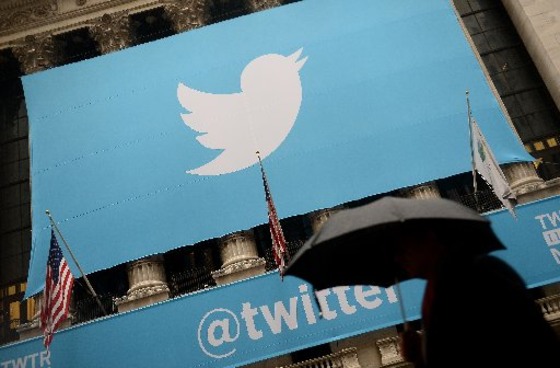

But maybe it's destined to stay small, serving a vital, if limited, role for the public. Maybe Twitter just isn't meant to be an all-encompassing social utility. Maybe stock price is not the only lens through which a company can be valued. Twitter, perhaps even in spite of its difficult interface and site-specific lingo, has become a cultural force since its 2006 founding.

Read More: Twitter Stock Plunges After Revenue Misses Estimates

"I don't think at this point Twitter is ever going to reach the size of Facebook and I don't know if that necessarily matters," says Debra Aho Williamson, an analyst at research firm eMarketer. Assuming, that is, that Twitter can figure out some way to make money off people who read tweets but don't ever log into the service.

Things got no better on Tuesday, when Twitter again reported largely stagnant user figures — 310 million, up from 305 million in the fourth quarter. (The company had previously reported 320 million users in the fourth quarter, but it has changed how it counts them).

This makes Twitter less than one-fifth Facebook's size. It can't even brag about being larger than LinkedIn, its more buttoned-up (and buttoned-down) professional networking cousin.

Read More: Twitter CEO Jack Dorsey on Whether Platform Censors Users: 'Absolutely Not'

While Twitter's per-share earnings beat Wall Street's expectations, revenue fell short. Revenue grew 36 percent to $595 million from $436 million a year earlier. Analysts polled by FactSet had expected $607.9 million. Twitter's already-clobbered stock fell $2.28, or almost 13 percent, to $15.49 in after-hours trading.

Ever since returned to helm the company he co-founded in 2006, CEO Jack Dorsey has insisted that Twitter needs to work harder at both attracting new users and giving occasional visitors more reasons to check back in. To date, neither has happened.

"Twitter's problem is that the management does not understand what they have," said Wedbush Securities analyst Michael Pachter, who argued that the company is still failing to retool itself for new users.