WASHINGTON — The state of the U.S. economy is a big driver of results in every election. But going into the 2024 campaign cycle, there are more questions than hard answers about what it means for President Joe Biden’s re-election chances.

Is the economy “good” or “bad”? Getting “better” or “worse”? It depends on whom you ask and, of course, whether there is a “D” or an “R” by their names. The data presents a complicated picture — one that seems to be more about where people think the economy is going rather than where it is at the moment.

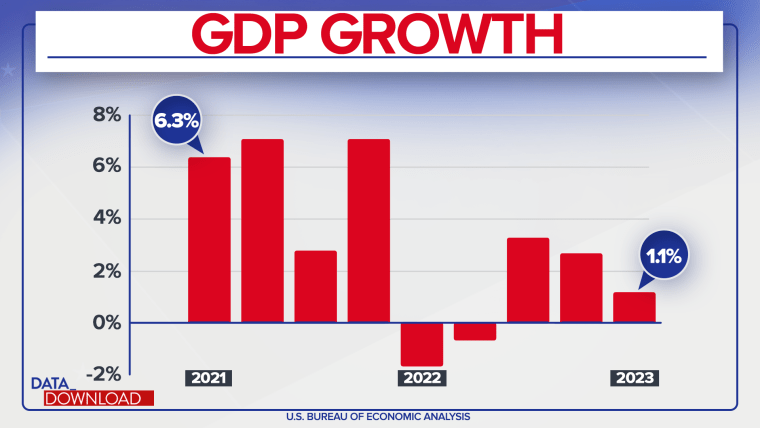

Going by the broadest measure — is the “economy growing or shrinking?” — the news is actually pretty good. For all the nail-biting over a coming recession, the gross domestic product data looks positive.

It has been hard to measure economic health in the pandemic and post-pandemic world. The early days of the Biden administration were marked by rapid, even extreme, growth and a yo-yoing pattern in the numbers, as Covid vaccines and variants played havoc with work schedules and office routines.

The extraordinary growth of 6.3% and 7% in the first two quarters of 2021 gave way to dips in the first two quarters of 2022.

Since then, however, the numbers have looked a bit more stable and in the range of normal figures. GDP grew by 3.2% in the third quarter of 2022 and by 2.6% in the fourth quarter. The early numbers for the first quarter of 2023 show a slowdown to 1.1% growth, but that’s still growth.

And the Federal Reserve has been aiming for slower growth — remember all those interest rate increases? — hoping to prevent the economy from overheating and bring it in for a “soft landing.” The data suggests they just might be able to pull it off, especially when you look at the economy through other lenses.

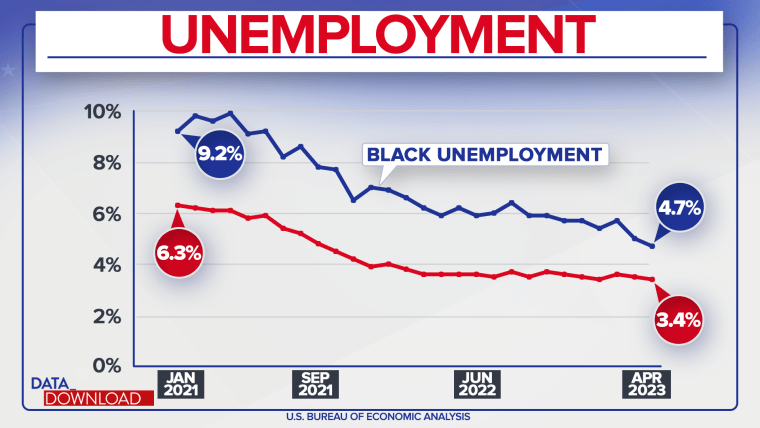

Consider unemployment. For many people, that good or bad economy question boils down to one issue: Are jobs available for those who want to work? And the answer right now is an unequivocal yes.

The unemployment rate for April was 3.4%. That’s tied with January for the lowest rate in more than 50 years. And the unemployment rate among African Americans is at all-time low, at 4.7%.

The Black unemployment rate has historically and consistently been higher than the overall unemployment rate, and it still is. But the gap was only 1.3 percentage points in April. That’s lower than it was even in the summer of 2019, when African American unemployment hits its pre-pandemic historical low of 5.3%.

In short, the unemployment numbers are more than solid; they are strong — and they certainly don’t suggest an economy that is sliding into recession.

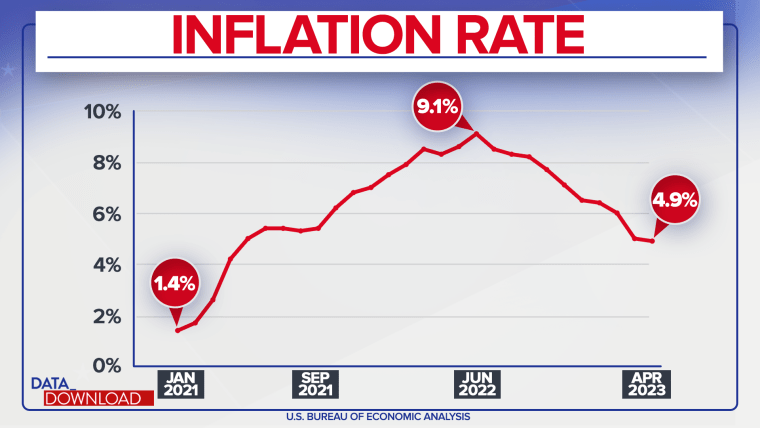

Of course, the biggest cloud hanging over the Biden administration economy has been inflation. Conversations with voters are usually peppered with comments about higher monthly bills for goods from groceries to cars.

The latest data suggests inflation is still a problem, but a declining one.

When Biden took office and the economy was still largely frozen, inflation was at a barely noticeable 1.4%. The rate started climbing rapidly to the 5% range in the second half of 2021 as the economy geared up — and it kept climbing with government spending, past 6% and 7% and even 8%. The inflation rate finally topped out at 9.1% last June.

But since then, it has been dropping steadily. April’s figure of 4.9% was the lowest it has been since April 2021. That’s still not great news for consumers who feel they are paying too much, but it does suggest Washington has gotten a handle on the problem — at least somewhat.

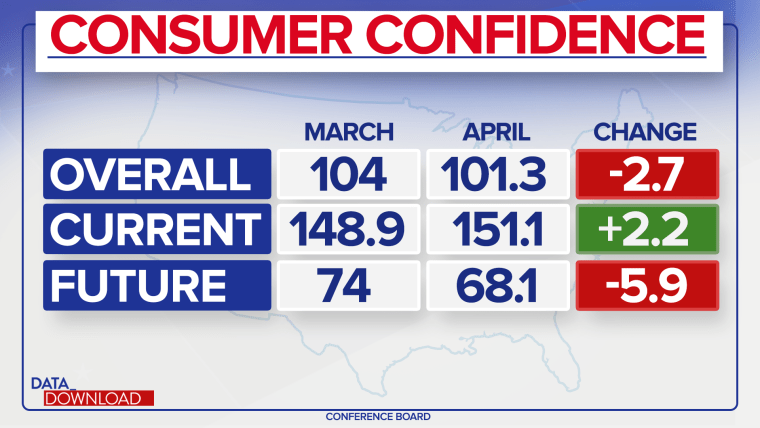

What do all those numbers mean to voters? That’s not completely clear. A lot of the economy is psychology — what voters think about all the elements that go into it — and that quickly gets complicated.

“Consumer confidence” as measured by the Conference Board shows a mixed picture.

Overall, consumer confidence took a slight dip in April to a score of 101.3, compared to 104 in March. The baseline number for the index is 100.

But when consumers were asked to assess the economy’s present situation, the score rose in April compared to March, climbing to 151.1 from 148.9. That is, consumers felt better about the economy in April than they did in March.

So what drove the overall number down? Where consumers think the economy is going. The “Expectations Index,” which measures where consumers believe the economy will be in six months, fell to 68.1 in April, down from 74 in March.

The expectations number is significant for a few reasons. First, when it is below 80, it has traditionally meant a recession is expected in the next year. Second, the figure has been below 80 every month since February 2022 (except for a brief sunnier view in December) — and the U.S. hasn’t yet experienced a recession.

In other words, it seems much of the pessimism about the economy is based on what people think it will do, which no one really knows.

There are reasons for concern, of course, starting with the big uncertainty that hangs over the debt ceiling fight. But consumer “expectations” are always something of a guessing game, and that is doubly true in the current strange economic environment.

And, in terms of politics, add this to the calculations: The 2024 election is still 17-plus months away. At some point, we will find out whether those consumer concerns about the future pan out or fade away. As they sit, however, many of the most important economic numbers present a mixed picture at worst. And at best, things look fairly positive.